ABOUT GDV

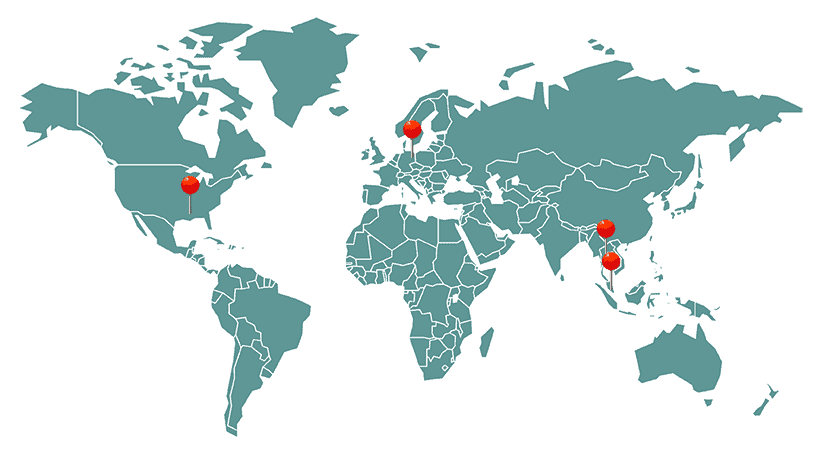

Established in 2020, Garden District Ventures is a consumer-focused investment fund that discovers, invests in, and supports remarkable entrepreneurs and high-growth potential companies in emerging, middle-income markets across Southeast Asia and beyond.

Our thematic approach involves identifying the intersections of market dynamics and demographic shifts, which we believe harbor growth opportunities over the next 2- to 20+ years.

Fundamental changes in global consumption patterns, value-driven purchasing behavior, supply chain realignments, the rise of online learning and entertainment, and a renewed focus on personal care and wellbeing underpin our high-conviction investment strategies.

Principally speaking, our Garden District Ventures team is committed to backing those mission-driven startups that are disrupting the status quo, delighting their customers, and solving real-world problems.

OUR TEAM

Our Garden District Ventures team comprises humble, hard-working, and forward-thinking individuals—entrepreneurs, investors, and strategists—backing companies that have the potential to drive transformational change across the consumer ecosystem. Our ethos revolves around a culture of curiosity, a deep understanding of emerging market trends, and the enduring belief that our community is our currency.

All the while, he has built a diverse network across industries and enduring relationships from Boston to Budapest to Bangkok. Through these experiences, Jason channeled his entrepreneurial learnings into an investment ethos oriented around “food, families, freight, and finance” and guided by virtues of social responsibility and untapped human potential.

Jason is an investor and shareholder in over two dozen global companies, several of which have exited via IPO or acquisition, notably Beyond Meat (NASDAQ: BYND), Instacart (NASDAQ: CART), Freightos (NASDAQ: CRGO), Zoomcar, Rewire, and others. He is a Corporate Member of The Conference Board, mentors with Techstars and Seedstars, and is deeply passionate about entrepreneurship, cross-border commerce, and the vast opportunities in emerging markets.

Outside of work, Jason supports causes including cancer survivorship, global hunger and homelessness, and the environment. He loves skiing, kayaking, camping, craft beer, listening to brass bands, and reading everything he can get his hands on. To date, Jason has traveled to 50+ countries, where he is endlessly inspired and humbled by people and places.

As the Founder of GLO Airlines, a New Orleans-based regional airline launched in 2015, he navigated the numerous barriers to entry around aircraft leasing, federal regulatory requirements, hiring and training, route selection, and establishment of hubs across the Gulf South region. In 2017, Trey provided testimony before the United States Congress, offering expertise on the future landscape of regional air travel and its regulatory aspects.

His professional journey began at A.P. Møller–Maersk, where he contributed to a team managing vessel and cargo operations for African and South American services into all discharge ports in the U.S. In addition, he has also served as Managing Director of Cornerstone Gas Corporation and Founding Principal at Coliseum Property Group.

Trey earned a J.D. from Tulane University Law School, studied Shipping, Trade, and Finance at City University London, and received his B.A. in Political Science from Southern Methodist University.

An avid outdoorsman, Trey lives in Charleston, South Carolina, with his wife and young children.

Muieen's journey in entrepreneurship began during his undergraduate years at The University of British Columbia, where he served as the go-to business expert for engineering students. Together, they collaborated on several innovative projects, laying the foundation for Muieen's experience in the entrepreneurial ecosystem. Fast forward to today: Muieen is back in the classroom and lecturing part-time at Tulane University, teaching “Learning in Venture Capital,” a two-week intensive course to MD/ MBA students.

As a dedicated supporter of OpenVC, one of the largest open-source databases of venture firms globally, he actively contributes to the platform and helps demystify the venture capital landscape by sharing his insights at muieen.medium.com.

Muieen has also made significant contributions during his tenure as Program Director at the New Orleans BioInnovation Center, where he supports early-stage life science startups and manages various initiatives and programming. As a Venture Partner at Garden District Ventures, Muieen plays a significant role in the firm's Southeast Asian deal sourcing, developing predictive strategies and risk profiles for startups, and making investment recommendations.

As a “Gen Z” founder-turned-investor based in Bangkok, Richard is the Co-Founder of Oho!, a food-tech startup addressing the trillion-dollar food waste problem. He has backed over 70 companies from Pre-Seed to Series A across consumer-focused sectors, always seeking category-leading startups that can drive a transformative future. Through the strategic use of social media and a large follower base, Richard boosts the visibility and growth of his portfolio companies.

Richard is a Limited Partner at Garden District Ventures, a Venture Partner at TA Ventures, and shares expertise and mentorship to fuel aspiring founders around the globe.

We cannot drive people; we must direct their development. Teach and lead.

INVESTMENT FOCUS

Garden District Ventures is investing in Southeast and South Asian startups through our Consumer23 Fund. We’re particularly drawn to disruptive ideas that simplify daily life in emerging middle-income markets and those companies that can hear the voices of their future customers.

We love big-picture, long-term sustainable consumer verticals that benefit people and the planet. These include food and ag tech, digital health & wellness, maritime tech and SCM, Future of Work, O2O marketplaces, the circular economy, and others.

We prefer to get involved with companies early on, most often ahead of a Seed round. This is typically when there’s a team in place, an MVP, some early traction, and a growing base of customers and users signing up and using the product. However, it’s never too early to connect, as many big ideas started on a napkin.

While each investment is unique, our initial ticket sizes range from $100K to $250K with the expectation of participating in follow-on rounds. We also co-invest alongside other funds and partake in investor syndicates and secondary deals when opportunities arise.

From mentorship to media placements to “soft landing” our portfolio companies in U.S. markets, we tap the power of our global network to help startups win. We believe that venture capital is a team sport, and we’re on the lookout for founders ready to embark on a lasting journey.

To be equitable, economic growth has to be sustainable.

WHY SOUTHEAST ASIA?

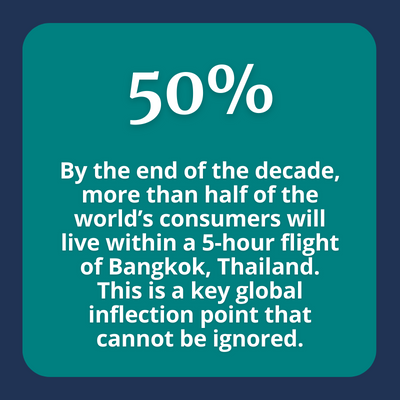

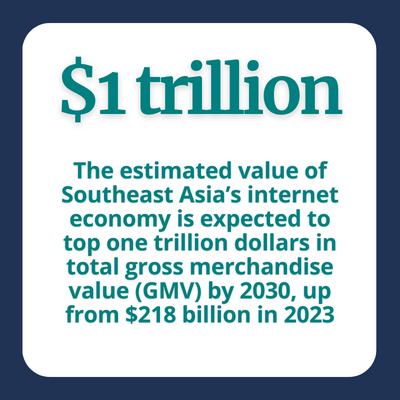

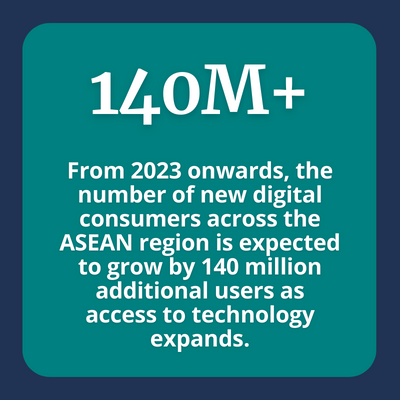

Spanning eleven nations and home to 685 million residents, Southeast Asia is one of the most dynamic and culturally diverse regions on the planet. With an aggregate GDP reaching $3.6 trillion and a median population age of 30 years old, the region encapsulates dynamism and promise. Regional startup ecosystems have experienced unprecedented growth propelled by extensive digital integration, cross-border investment and trade agreements, and market-oriented economic reforms.

Energy is necessary for economic growth, for a better quality of life, and for human progress.

Garden District Ventures believes in doing well by doing good and we’re always on the hunt for new opportunities. Interested in sharing your startup story with us?

Please take a moment to review our FAQ section and connect with us using the form below. A member of our team will then be in touch with you to schedule a conversation. We value you reaching out and thank you for your interest in Garden District Ventures.